GIC group president and former civil service head Lim Siong Guan spoke on honour, wealth, leadership and Mr Lee Kuan Yew’s legacy at a Business Times conference last Tuesday. Here are edited excerpts of his speech that were published in The Straits Times on 6 April 2015.

OFTEN when visitors come to Singapore, they are briefed on the Housing Board, the Central Provident Fund, the Urban Redevelopment Authority, the education system, the health system and so on.

While these are critical factors, I believe there is a deeper cultural reason to explain Singapore’s success since independence.

The explanation lies in an ability to trust Singapore, where promises are kept, the rule of law is maintained, justice is assured, intellectual property rights are protected, meritocracy is practised and government policies are consistent and predictable.

Singapore offers integrity, incorruptibility, reliability, quality and trustworthiness, keeping promises even though it may involve lots of hard work and overcoming unexpected difficulties.

“Trust” and “trustworthy” are the key words.

Trust is the lifeblood that determines the quality of relationships that undergird every community and society.

And honour is the foundation of trust, where the people, businesses and government deliver on their word of honour.

Singapore’s success in the last 50 years is the result of human imagination and hard work, as well as the courage to be different and unique, founded on honour, integrity and trust that the people of Singapore will do what is good and right for themselves, their families and their society.

It is a matter of “enlightened self-interest”, where honour makes good sense for life, living and livelihood.

This still has to be the blueprint for the continued success and survival of Singapore.

As we look into the future, we can also expect an increasing desire by citizens to speak out on a widening array of national issues, and to be able to act on their own initiatives but with government support or, at least, tolerance if not approbation.

In order to maintain peace, harmony and stability even in such times of debate, there must be a national consensus that all things are done with a view to enhance the well-being of the nation for the generations to come.

To achieve this, there must be a strong vein of honour and mutual respect between individuals even when there may be sharp differences in views.

Attitudes towards wealth

IN THE early years, Singapore was poor, and the life attitude of both the people and the Government was that of a “poor man” – life is uncertain, earn what you can, save what you can, spend on what you need, we never know what tomorrow will bring, so be prepared and save for the rainy day.

So Singapore was at Point A of the Grid – country is poor, and life attitude of the people is that of a poor man.

With the passage of time, Singapore became rich. But many people still perceive the Government as having the attitude of the “poor man”.

So the people reckon Singapore is at Point B of the Grid, though some people have said that, in fairness, the Government is not at Point B but at some point between B and C.

However, what the people are wondering is, if we are really rich, shouldn’t we be at Point C of the Grid – country is rich and the Government provides for the people – for a life attitude of that of a rich man?

And that, to my mind, is the fundamental reason for much of the angst between the people and the Government: The people reckon we should be at Point C, while the Government is perceived as sticking to Point B.

The Government, understandably, has the particular concern that if Singapore is at Point C, it could be setting itself up to fall into Point D of the Grid, where the country is in fact poor, but the Government provides for the people as though they are rich.

The interesting question is: Are there countries at Point D of the Grid?

Many observers reckon there are indeed many countries at Point D, starting with Greece as the obvious case, and then the United States, Europe and Japan, where people have been used to having their governments adopt policies and provide benefits like a “rich man”, but in fact these governments no longer have the revenues to support such policies, so they borrow to be able to continue to extend the benefits to the people and have huge sums of unfunded liabilities.

The “poverty” of these governments is often “invisible” because of their “pay-as-you-go” pension schemes, social security schemes and medical support schemes, where the pension and benefits for the retirees are paid for by collections from the working population, a formula under threat as the working populations dwindle with low birth rates and immigration, while the retiree populations balloon with increased life expectancies arising from advances in medicine and healthcare.

The interesting question is: Can Singapore recover from Point D, should it fall from Point C to Point D?

Because if Singapore can recover from Point D to Point C, rather than inexorably go from Point D to Point A, perhaps the risk of getting to Point C may be worth taking. Singapore had made it from Point A to Point B by astute national leadership.

It was leadership making good use of opportunities arising from a confluence of geostrategic factors, whether it was the withdrawal of British military forces east of Suez or the Vietnam War or the Plaza Accord.

The situation is different today, so that the chances of recovering from Point D to go back to Point C rather than Point A are far from assured.

Why risk it?

Perhaps the Government thinks the chances of avoiding Point D are best assured by staying at Point B.

The real discussion that is necessary, in my mind, should be to first recognise the disconnect in a public perception of the Government being at Point B while the public desire is to be at Point C, and to have a good national debate on how to keep staying at Point C if Singapore moves there.

This national debate has to be centred on two questions: What economic policies does Singapore need to keep the wealth level up?

What social policies does Singapore need to keep spending and expectations within sustainable limits?

Young must seek to lead

WE FACE what has been referred to as a VUCA world – a future that is Volatile, Uncertain, Complex and Ambiguous.

It will be impossible to deal with complexity in a reactive mode. Big data is the catchword today, and certainly a lot more benefit and opportunity are waiting to be discovered and mined.

And to the fear that computers will take over the world one day, as computers become smarter and smarter, has come the riposte: Humans must become smarter than the computer, and they can be if they work at it.

While computers may crunch the numbers faster, humans must imagine better.

The way to deal with complexity and ambiguity is for leaders to offer a clear vision, and then figure out how the vision intersects with what parts of the complex world.

We cannot afford to have leaders who lead by crisis, whose approach is reactiveness and whose agenda is simply to do what the people want them to do.

Leaders must be anticipative and able to communicate a worthy future.

They are leaders whose values are clear, whose idea of “good” carries the support of the people, whose principles for thought and action are exemplary, who are not arrogant but confident, who are consistent yet flexible, who are steadfast yet adaptable, whose intent is always to be in time for the future while moving country and company to be the best it can be, and whose heart always cares for the people.

As every generation needs its own leaders who understand their generation better and can more instinctively connect with them, the young in Singapore must not eschew leadership but seek it.

Dealing with the Vuca world requires young people who have self-confidence, courage, integrity, wisdom, judgment, energy and imagination.

In any competition, whether it be between countries or companies, energy and imagination always wins.

We must keep developing the next generation of leaders, who have to be competent, committed and confident.

Singapore needs leaders with vigour, spirit and courage. Because leadership is about making things happen, success is never guaranteed and the path is often uncertain.

Stand on the shoulders of giants by learning from our forefathers who have built Singapore into what it is today, but we must seek to exceed them, to chart our own path because our circumstances are different from theirs.

It is not what they did per se that is important, but the spirit and attitude in which they conducted themselves that merit learning.

Their qualities of boldness, uniqueness, pursuit of excellence, unwavering determination, readiness to learn from mistakes and reliability should serve as our compass of values and principles as we sail forth into uncharted waters.

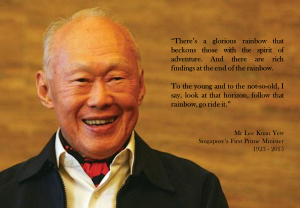

The Lee Kuan Yew spirit

WE MUST not miss the legacy of Mr Lee Kuan Yew. It is not the bustling metropolis that is Singapore, nor is it Singapore’s entry into the class of First World economy from Third World.

Mr Lee’s legacy is the spirit of courage and imagination, integrity above all else, delivering on promises and being a people of our word.